Bismarck, N.D. – There’s growing concern in North Dakota, and nationally, about a steady rise in farm debt and loan delinquency rates thanks to higher operating costs.

According to the Kansas City Federal Reserve, total farm debt in the U.S. rose by 7% in 2024, as loan demands from producers are increasing this year.

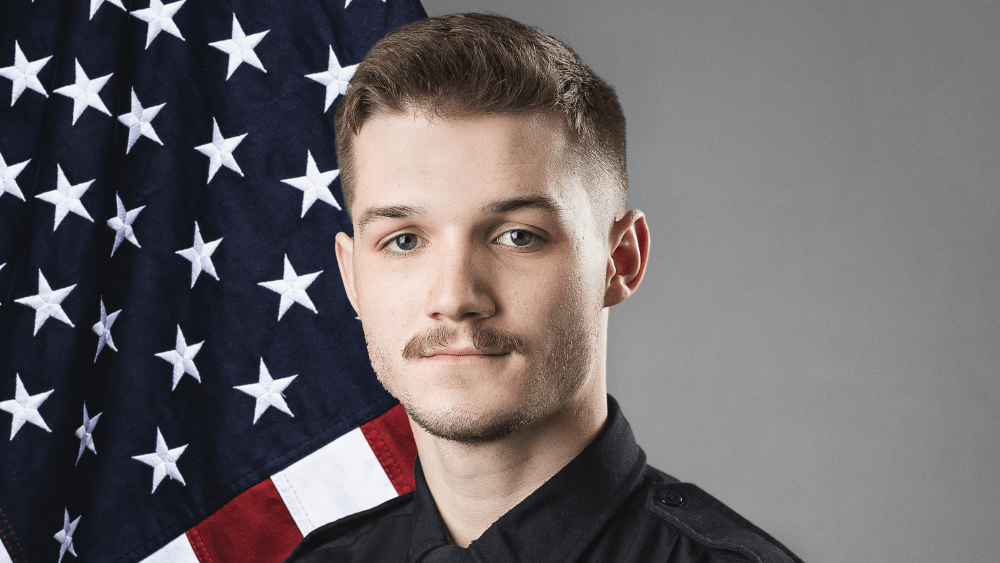

“We were going into this spring with about 20-percent of producers who are borrowing for their operating [costs],” said North Dakota Agriculture Commissioner Doug Goehring on The Flag. “We’re having some real difficulty and challenges.”

As crop prices are dropping, the cost of fertilizer, machinery and fuel has remained stubbornly high.

Goehring says the average farm in central North Dakota generates a million dollars in gross revenue, but the expenses are “astronomical.”

“If you owe $900,000 just to operate your farm and service your debt and you’re sent a $70,000 [bailout] check….you’re still $300,000 away from breaking even,” said Goehring.

“We are so far below the cost of production right now that I’m not sure how we can bail them out. You can’t send a check big enough to cover this debt.”

Listen: North Dakota Agriculture Commissioner Doug Goehring on ‘What’s On Your Mind?’

In the short term related to natural disasters like severe weather that destroyed millions of bushels of grain storage in June, Goehring says a loan assistance program established through Governor Armstrong and the Industrial Commission should help stop some of the bleeding.

“If they [farmers] know they have an adjuster in a company that they’re not able to get paid for right now, at least they can start rebuilding some of that storage,” said Goehring. “When they get their insurance check, they can pay that loan off.”

Goehring hinted at looking to see how the rest of the year progresses in terms of finding solutions to the greater debt issue.

“This is dire and it’s going to be telling to see what happens by October or November if there is no change by then,” said Goehring.

Goehring also likes what was included in the ‘FARMERS’ Act, which was approved within President Trump’s spending bill.

Some of the benefits include higher reference prices for agriculture and price loss coverage, along with strengthening and expanding access to affordable crop insurance.

“There are some attempts and good progress to be made that affect our state,” said Goehring.